Percentage of taxes taken out of paycheck

For a single filer the first 9875 you earn is taxed at 10. In fact 848 municipalities have their own income taxes.

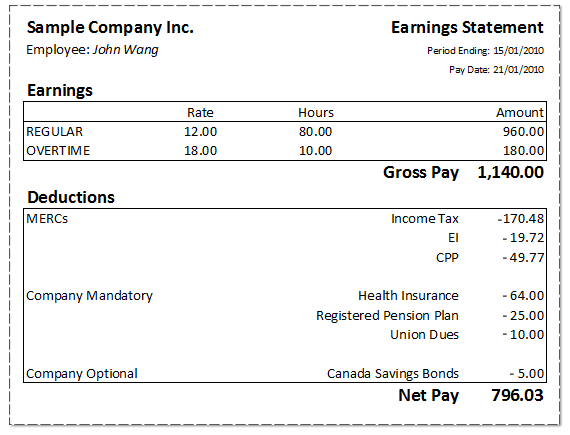

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

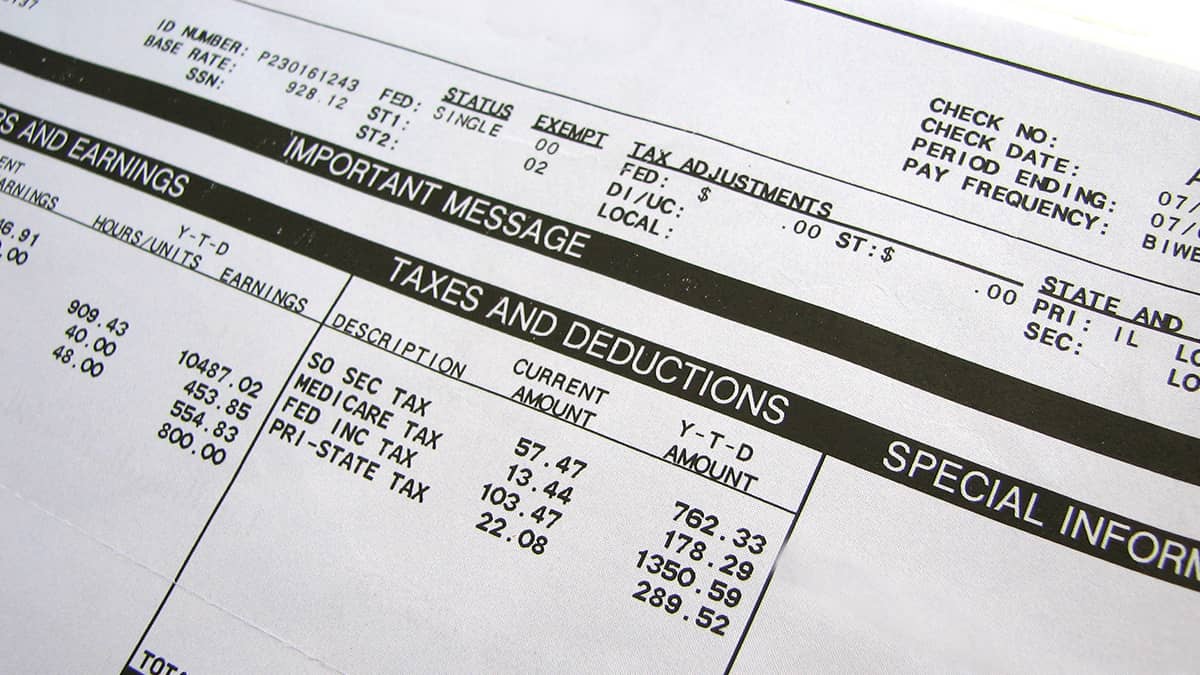

Total income taxes paid.

. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. The employer portion is 15 percent and the. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes.

How Your New Jersey Paycheck Works. For the first 20 pay periods therefore the total FICA tax withholding is equal to or. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. Many cities and villages in Ohio levy their own municipal income taxes. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

How Your Pennsylvania Paycheck Works. These payments are usually pre-tax which. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W.

What percentage of federal taxes is taken out of paycheck for 2020. If you take advantage of employer-sponsored health or life insurance premiums you pay on these will be deducted from your paycheck as well. Add up all your tax payments and divide this amount by your gross total pay to determine the.

These are contributions that you make before any taxes are withheld from your paycheck. For instance the first 9525 you earn each year will be taxed at a 10 federal rate. The federal income tax has seven tax rates for 2020.

What is the percentage that is taken out of a paycheck. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Your employer uses the information that you provided on your W-4 form to.

You owe tax at a progressive rate depending on how much you earn. 10 percent 12 percent 22 percent 24 percent 32. The state tax year is also 12 months but it differs from state to state.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. For federal income taxes and FICA taxes employers withhold these from each of. How Your Arkansas Paycheck Works.

Some states follow the federal tax. FICA taxes are commonly called the payroll tax. Federal income taxes are also withheld from each of your paychecks.

Total income taxes paid. Amount taken out of an average biweekly paycheck. FICA taxes consist of Social Security and Medicare taxes.

Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. However they dont include all taxes related to payroll. The amount of federal income tax.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. What percentage of taxes are taken out of payroll. Arkansas residents have to pay taxes just like all US.

The federal income tax has seven tax rates for 2020. The current rate for. Social Security and Medicare combined payments are sometimes listed as FICA.

You pay the tax on only the first 147000 of. Only the very last 1475 you earned. How do I calculate taxes from paycheck.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Irs New Tax Withholding Tables

What Are Payroll Deductions Article

Check Your Paycheck News Congressman Daniel Webster

The Measure Of A Plan

Understanding Your Paycheck Credit Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Taxes On Paycheck Best Sale 52 Off Www Ingeniovirtual Com

Paycheck Taxes Federal State Local Withholding H R Block

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Here S How Much Money You Take Home From A 75 000 Salary

Pay Stub Meaning What To Include On An Employee Pay Stub

Taxes On Paycheck Best Sale 52 Off Www Ingeniovirtual Com

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Taxes On Paycheck Best Sale 52 Off Www Ingeniovirtual Com

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Paycheck Calculator Online For Per Pay Period Create W 4